capital gains tax increase date

There is currently a bill that if passed would increase the. Dems eye pre-emptive capital gains effective date.

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

An immediate effective date would prevent taxpayers from selling assets and engaging in transactions.

. Democratic lawmakers have quietly begun discussing whether to make a proposed increase in the individual capital gains rate effective on the date the proposal is introduced. President Joe Biden proposed a top federal tax rate of 396 on long-term capital gains and qualified dividends. While the proposed increase is not as severe as originally feared the top capital gains tax would see an increase from 20 to 25.

With tax writers launching mark-ups as early as Sept. We are the American Institute of CPAs the worlds largest member association representing the accounting profession. The Biden administration proposed that its capital gains tax increase apply to gains required to be recognized after the date of announcement presumably late April 2021 The House proposes that its capital gains increase apply to sales on or after Sept.

The New Democratic Party NDP in particular pledges to increase the capital gains rate to 75. Appendix Top 2020 marginal tax rates for capital gains and dividends The following table illustrates the current top marginal tax rate on capital gains by provinceterritory as well as the potential top marginal tax rate on capital gains if the inclusion rate increases to 66 2 3 or 75. Currently the capital gains rate is 20 for single taxpayers with income over 441451 and for taxpayers who are married filing jointly with income over 496601.

Presently the capital gains inclusion rate for realized or deemed realized capital gains is 50. A higher tax rate on capital gains would negatively impact investment and harm American businesses. Democrats have made an increase in the capital gains rate a major priority in their upcoming reconciliation tax bill and the potential effective date is critical for many investment decisions.

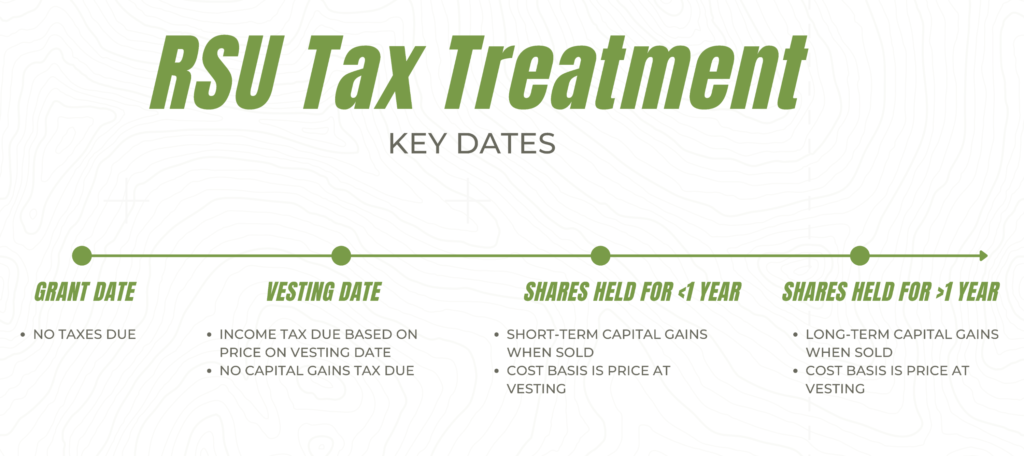

In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. Under this proposed tax combined federal and state taxes on capital gains would average 48 percent itself a 66 percent increase over current law exceed 50 percent in thirteen states and the District of Columbia and reach 582 percent in New York City12 The combined average federal and state capital gains would surpass Denmark Chile. The table also shows the inclusion Eligible.

If a capital gains tax increase is enacted advisors will encourage many clients to try and sell assets as soon as they can. 4 rows The proposal would increase the maximum stated capital gain rate from 20 to 25. 27 deadline there could be imminent action triggering an effective date tied to an upcoming date.

In addition to raising the capital-gains tax rate House Democrats legislation would create a 3 surtax on individuals modified adjusted gross income exceeding 5 million starting in. Plus a change to the capital gains rules with a midyear effective date eg a 20 top capital gains rate for pre-April 2021 sales and a 396 top capital gains rate for sales made in April 2021 or later would be a logistical nightmare for. Could an increase to say 67 as it was from 1988-89 or 75 as it was from 1990-1999 happen.

The Tax Policy Center found that capital gains realization increased by 60 before the capital gains tax was increased from 20 to 28 by the Tax Reform Act of 1986 effective in 1987 and by 40 in 2012 in anticipation of the increased maximum tax rate from 15 to 25 in 2013. 13 2021 unless pursuant to a written binding contract effective on or before Sept. That applies to both long- and short-term capital gains.

This tax hike would harm economic growth and decrease liquidity as holders of assets would be less inclined to sell. With average state taxes and a 38 federal surtax the wealthiest people would pay. Well be watching closely.

Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income. Today youll find our 431000 members in 130 countries and territories representing many areas of practice including business and industry public practice government education and consulting. NDPs proto-platform calls for levying.

Hawaiis capital gains tax rate is 725. Still another would make the change. The current estimate of that effective date ranges from October 15 2021 on the early.

Another would raise the capital gains tax rate to 396 for taxpayers earning 1 million or more. Our history of serving the public interest stretches back to 1887. Capital gains tax rates on most assets held for a year or less correspond to.

It is expected that the long-term capital gains tax rate change will be effective the day it is agreed to and announced with little to no advance warning. This provision would increase the top capital gains rate to 25 percent. 9 and racing against a Sept.

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

Selling Your Home Low Incomes Tax Reform Group

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

Capital Gains Tax What It Is How It Works What To Avoid

Capital Gains Tax On Gifts Low Incomes Tax Reform Group

Capital Gains Tax For Individuals Not Resident In The Uk Low Incomes Tax Reform Group

Nft Tax Guide What Creators And Investors Need To Know About Nft Taxes Taxbit Blog

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-02-e2a3aeb7d91347578e72df8195d0e8f0.jpg)

Get The Most Out Of Employee Stock Options

How Are Futures And Options Taxed

Uk Capital Gains Tax For British Expats And People Living In The Uk Experts For Expats

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)