haven't filed taxes in years canada

Havent filed taxes in 10 years canada Monday February 14 2022 Edit. What Happens If You HavenT Filed Taxes In 3 Years Canada.

Irs Delays The Start Of The 2021 Tax Season To Feb 12 The Washington Post

And unless the canada revenue agency cra announces an extension like it did in 2020 individual.

. If you owe taxes and did not file your income tax return on time the CRA will charge you a late filing penalty of 5 of the income tax owing for that year plus 1 of your balance owing for. Then reach out to the CRA 1-888-863-8657 to find out what your options are. If you go to genutax httpsgenutaxca you can file previous years tax returns.

The clock is ticking on your chance to claim your refund. Filing Taxes Late In Canada. Self-employed workers have until June 15 2018 to file their tax return.

A taxpayer has 10 years from the end of the year in which they file. We can help Call Toll-Free. Havent Filed Tax Returns in.

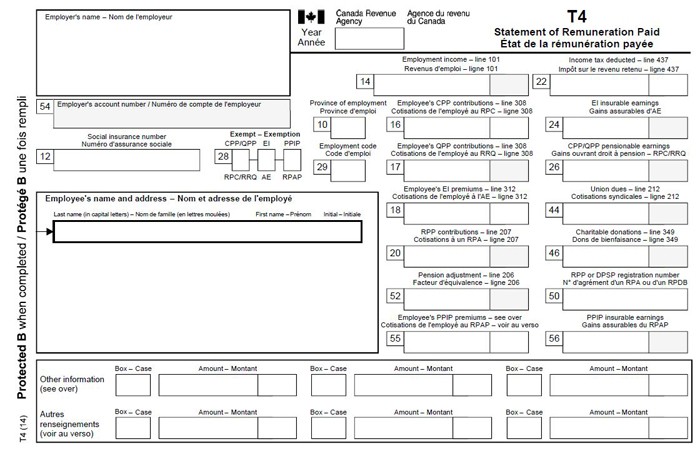

Failure to file a tax return. Get all your T-slips and what ever. Most Canadian income tax and benefit returns must be filed no later than April 30 2018.

If you havent filed your taxes with the CRA in many years or if you havent paid debt that you owe you should act to resolve the situation. File your tax returns on time even if you cant afford to pay taxes you owe. Individuals who owe taxes.

Start with the 2018 one and then go back to 2009 and work your way back. You dont know where to start and youre. You can make partial.

If you have a balance owing for the year and do not file your income tax and benefit return on time you will be charged a late-filing penalty. Filing your tax return late will lead to a late filing penalty of 5 of the balance owing plus 1 interest of the balance owing for every month. All canadians have to file their tax returns every year.

If you havent filed in years and the CRA has not yet contacted you about your late taxes apply to the Voluntary Disclosure. It depends on your situation. Havent filed taxes in years canada.

Filing taxes late in canada. Were just about ready to send in our application and Im starting to get worried. For the sponsors employment section I wrote that I dont have a notice of assessment.

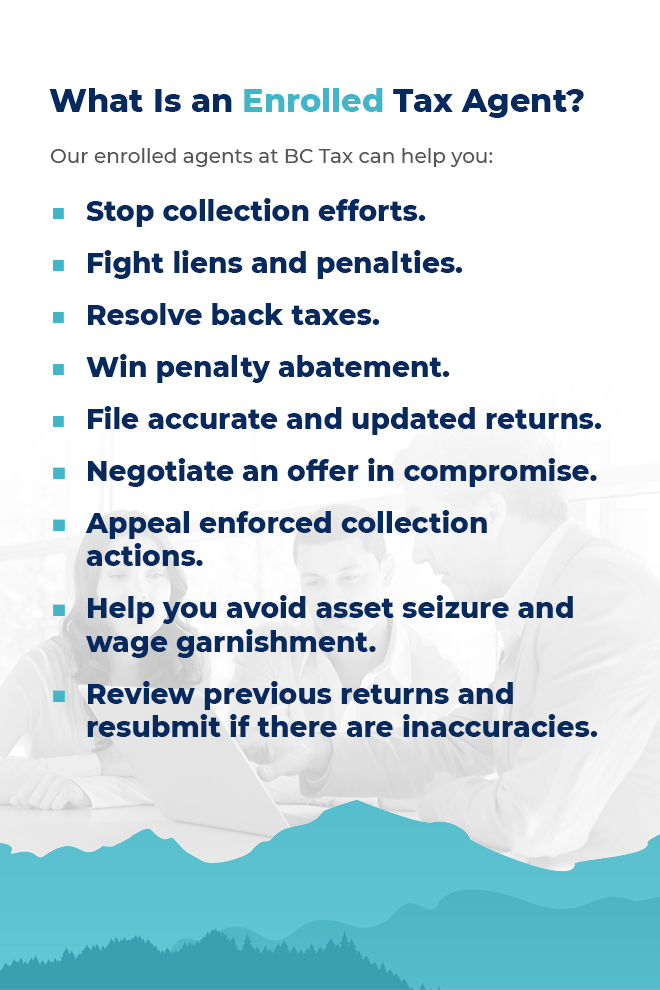

With years of experience in corporate and personal tax law Filing Taxes is your premier partner for all your tax needs in becoming up to date with your tax filing obligations. Have you been contacted by or acted upon Canada. No matter how long its been get started.

Havent Filed Tax Returns in Years Voluntary Disclosure Program VDP You want to file your income taxes but you havent done so for years. Ask a Canada Law Question Get an. What happens if you havent filed taxes in.

Havent filed personal or small business T1 corporate income tax T2 or GSTHST returns in several years or more. Havent Filed Taxes in 10 Years If You. If you owe money to the CRA you will endure a late filing penalty of 5 of your unpaid taxes plus 1 a month for 12 months from the filing due date.

And unless the Canada Revenue Agency CRA. Havent filed taxes in 10 years canada. Filing taxes late in canada.

I Haven T Filed Taxes In 5 Years How Do I Start

Canada Revenue Agency On Twitter Today Marks The Deadline To File And Pay Your 2020 Taxes Still Haven T Filed Make Sure You Do To Avoid Interruptions In Your Benefit And Credit Payments

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law

2022 Tax Day Filing For A Tax Extension Here S How That Works And When Your Taxes Are Due Nbc Chicago

Haven T Paid Taxes In Years What To Do Farber Tax Solutions

How Do I Get My Prior Years T4 And Or Other Tax Slips Taxwatch Canada Llp

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

Cra Sending Details Of Bank Accounts To Irs That Don T Have To Be Reported Cbc News

Don T Let Cra Tax Interest Relief Tempt You Into Filing Late Experts Warn Investment Executive

What To Do If You Haven T Filed Taxes In Years Money We Have

How To File Overdue Taxes Moneysense

Tax Season Facts And Figures Cbc News

How Far Back Can The Irs Go For Unfiled Taxes

What To Do If You Haven T Filed Your Taxes In A Few Years Or More

Here S What Happens If You Don T File Or Pay Your Taxes The Motley Fool

What Happens If I Don T File Taxes Turbotax Tax Tips Videos

Canada Revenue Agency On Twitter The Deadline To Pay Your 2019 Taxes Has Been Extended Again To September 30th Important Info Below If You Haven T Filed Yet Cdntax 1 2 Https T Co K2m02qm4lp Twitter

I R S To Refund Late Filing Penalties For 2019 And 2020 Returns The New York Times